What should I expect for my first log in to Online Banking?

Is 2FA be required for all users?

Yes, all users must enable Two Factor Authentication (2FA) for added security. For many clients this is as simple as enabling a text/SMS code.

What are my 2FA options?

Our platform has a robust set of 2FA options. You are encouraged to select the 2FA method that suits your needs. Some business clients with special permissions have different options.

| Type | Description | Security | Notes |

| SMS / Phone Call | Get a call or text and enter the number on screen | Good | Convenient. Beware of losing a cell phone or Port Out scams |

| Authenticator App | Get a push notification or open the app and enter the number on screen | Better | Ex: Google Authenticator, DUO, Microsoft Authenticator. |

| FIDO Security Key/Token | Plug a USB drive into your computer or phone charge port or tap near back of phone | Best | Currently best in class security method, ensuring even if your password is stolen, your account still cannot be accessed without your physical token device |

| Passkey (Biometric, PIN, Pattern) | Insert a biometric-enabled USB drive or use integrated face ID/thumbprint | Best | Currently best in class security method, ensuring even if your password is stolen, your account still cannot be accessed without your physical presence |

What if I would prefer to have a physical token?

If you prefer to have a physical security key/token, this will require action on your part.

- The security key must be in your possession in order to register it as a 2FA method.

- Because security keys should be unique to each person, the Bank takes a “Bring Your Own Token” approach which is in line with modern security standards.

- If you already have a security key/token used for another system access, you can use that for our Online Banking platform.

How do I purchase a FIDO compliant security key/token?

While there are many makes and models of FIDO security keys/tokens compatible with different device types, some users have reported good experiences with the brands and token types shown below. Signature Bank does not partner with or endorse any of these brands.

Shop with caution – ensure token device meets the FIDO standard and are purchased from reputable vendors to avoid scams. Both of these brands can be purchased directly from the company rather than through resellers.

| Brand | Model | Computer (USB-A) or Computer/Phone Port (USB-C) | NFC (Contactless phone protocol) | Biometric (Thumbprint) | Android / Apple Device Support | Approximate Cost | Notes |

| Yubico | Security Key NFC | USB-A | Yes | No | Both with NFC | $25.00 | Affordable and versatile option right for users with basic needs |

| Yubico | Security Key C NFC | USB-C | Yes | No | Android / New Apple / NFC | $29.00 | Affordable and versatile option right for users with basic needs |

| Yubico | Yubico 5Ci | USB-C / Lightning (legacy Apple) | No | No | Apple | $75.00 | Plug in only, supports older Apple devices |

| Yubico |

Yubikey 5 (C) Nano | USB-A USB-C |

No | No | Android / New Apple | $60.00 | Small version ideal for keychains. Plug in only |

| Yubico |

Yubikey A/C Bio | USB-A USB-C |

No | Yes | Android / New Apple | $95.00 | Uses thumbprint on a connected token. Biometric option without requiring a mobile device |

| Titan (Google) | USB-A/NFC Security Key | USB-A | Yes | No | Both with NFC | $30.00 | Affordable and versatile option right for users with basic needs |

| Titan (Google) | USB-C/NFC Security Key | USB-C | Yes | No | Android / New Apple / NFC | $35.00 | Affordable and versatile option right for users with basic needs |

I noticed the landing page displays my Available Balance. How can I find my Current Balance?

The Online Banking landing page will display your Available Balance. If you want to see your Current Balance, click on the account for balance details.

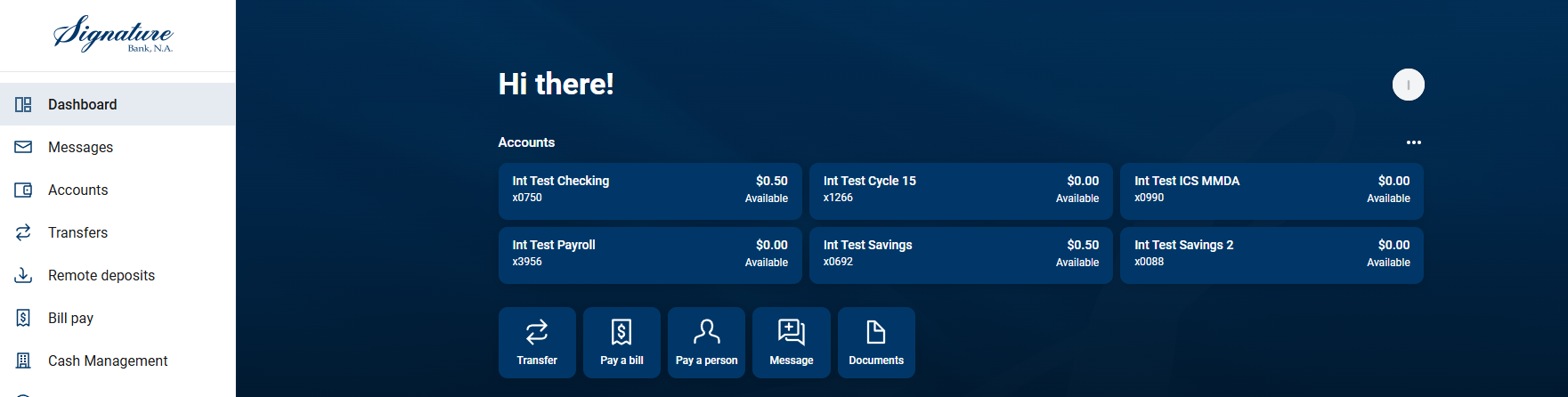

The Dashboard shows Available Balance:

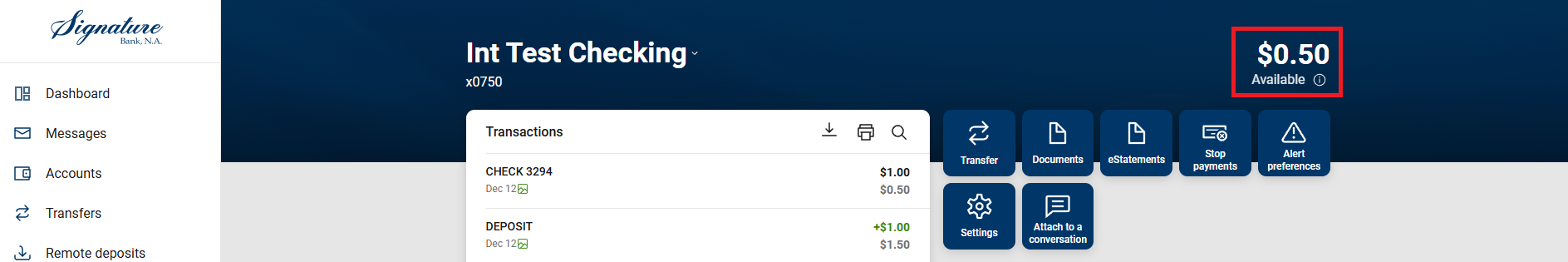

Click on the account you want to see details on:

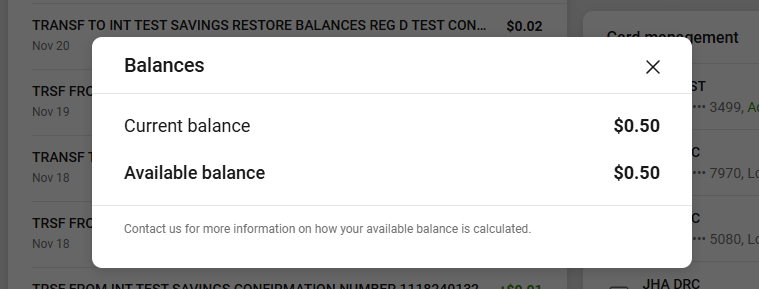

Click on the icon next to the word "available" to view the current balance details:

What is the difference between Current Balance and Available Balance?

The Current Balance is the balance as of the close of banking business the previous business day. Available Balances are more up to date as they include transactions expected to settle to your account today.

How can I download the mobile app?

- Download links are available on our website page linked above

- Or search for "Signature Bank, Toledo Ohio" and look for the app with our S logo (as shown below) from the applicable app store

Can I use biometric settings (FaceID, TouchID) to log into my mobile banking app?

Yes. This requires one time set-up of biometrics on the mobile banking app. It is necessary to have your Online Banking username and password for the first log in to the app and the first login on any new mobile device. Once logged in, you will be prompted to optionally enable biometrics depending on your device capabilities, settings, and preferences.

Can I make mobile deposits on the mobile banking app?

Mobile deposit is available on the mobile banking app for eligible deposit accounts.

Does Signature Bank’s Online Banking platform support data aggregators?

Yes, to promote our clients’ effective use of their Online Banking data, Signature Bank has established a modern Online Banking platform built on an API, or Application Programming Interface, which allows you to choose to connect certain third-party applications to your Online Banking. Many of these third-party applications use intermediaries, called data aggregators, to create connections for them.

Aggregators known to work with Signature Bank's new Online Banking platform include:

- Akoya

- Finicity by Mastercard

- Intuit

- MX

- Plaid

- Stripe

- Visa

- Yodlee

How can I connect a Third Party Application to Online Banking?

Connection of Third Party Applications to Online Banking happens from within the Third Party Application itself. The process varies widely by application. You may need to contact your application provider and request that they connect to our system or assist you in troubleshooting the connection.

What if I am using an app that is not able to integrate with the new Online Banking platform?

Signature Bank’s Online Banking platform is known to work with many major data aggregators, however, there are an unlimited number of data aggregators in the market, and it is impossible to guarantee support for every type of connection.

Our Online Banking platform includes important modern security features, including an API framework for connecting third party applications and programs to your Online Banking. This type of modern API connection replaces an older version of connectivity called screen scraping. Screen scraping is no longer considered to be an acceptable connection method in the financial industry because it lacks uniformity and certain safeguards for data as it travels between systems, leading to higher risk of compromise. It can also allow your applications to “pretend” to be human instead of identifying themselves as user-permissioned third party programs. For your security, our platform does not allow screen scraping. As a result, some applications that use this outdated connection method may not be able to connect to Online Banking.

We apologize for any inconvenience, but hope you understand why we have implemented this vital security measure into our platform. All major US banks are embracing API technology to safeguard client data, and the Federal Government is expected to require banks to stop allowing screen scraping for the security of the financial system.

If you encounter an application that does not connect because it is screen scraping, or simply has not built a connection yet, we are happy to refer your vendor or application provider to a resource that can help them learn how to connect to our platform using a modern API connection.

Can Intuit services like QuickBooks and Quicken be connected?

How do I view or manage connected apps?

Connections are primarily managed through the Third Party Application. Use extreme care in proving your credentials to any party or connecting Third Party Applications to your Online Banking.

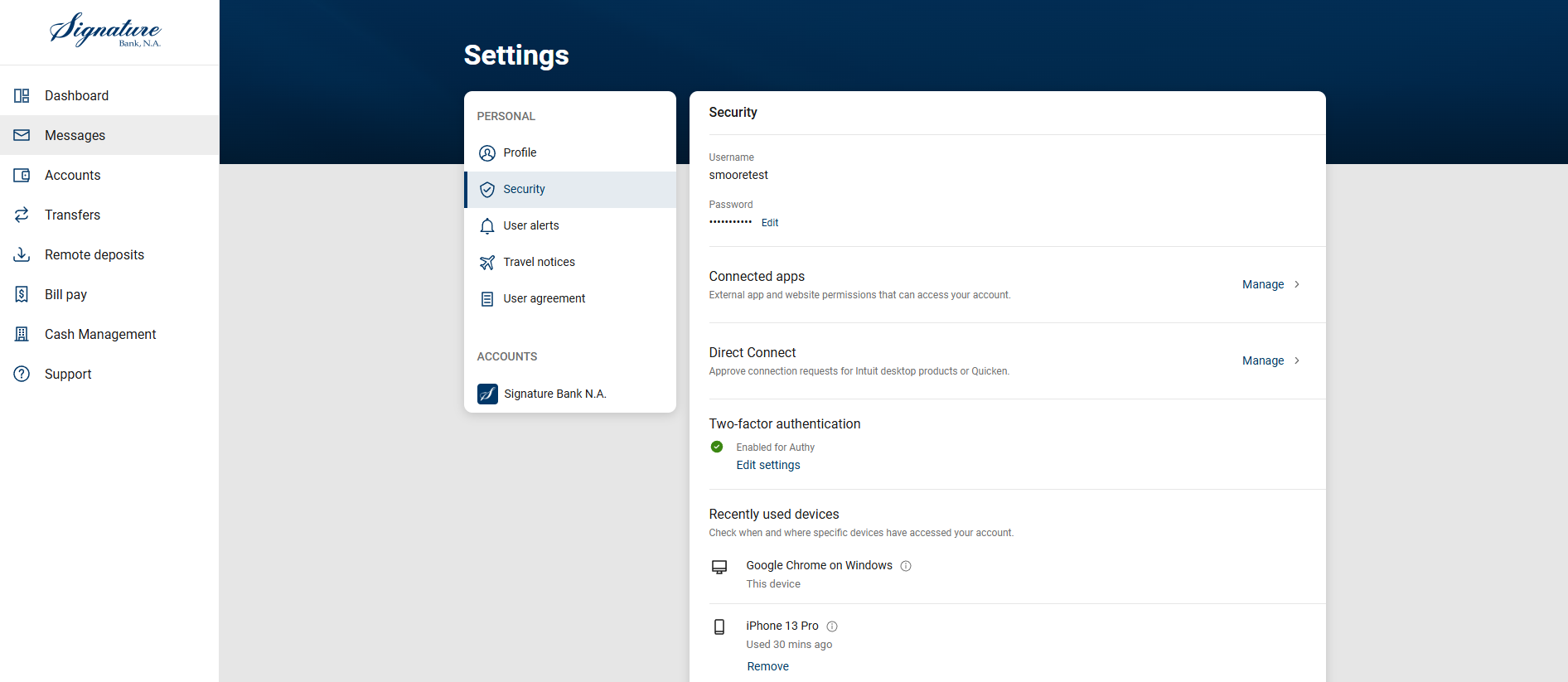

To manage known API connections from within Online Banking, navigate to Settings > Security > Connected Apps to view or manage your third-party app connections.

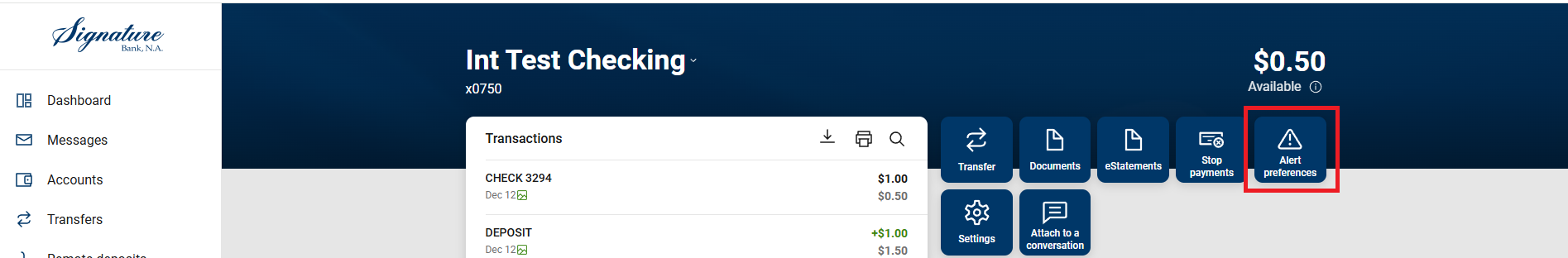

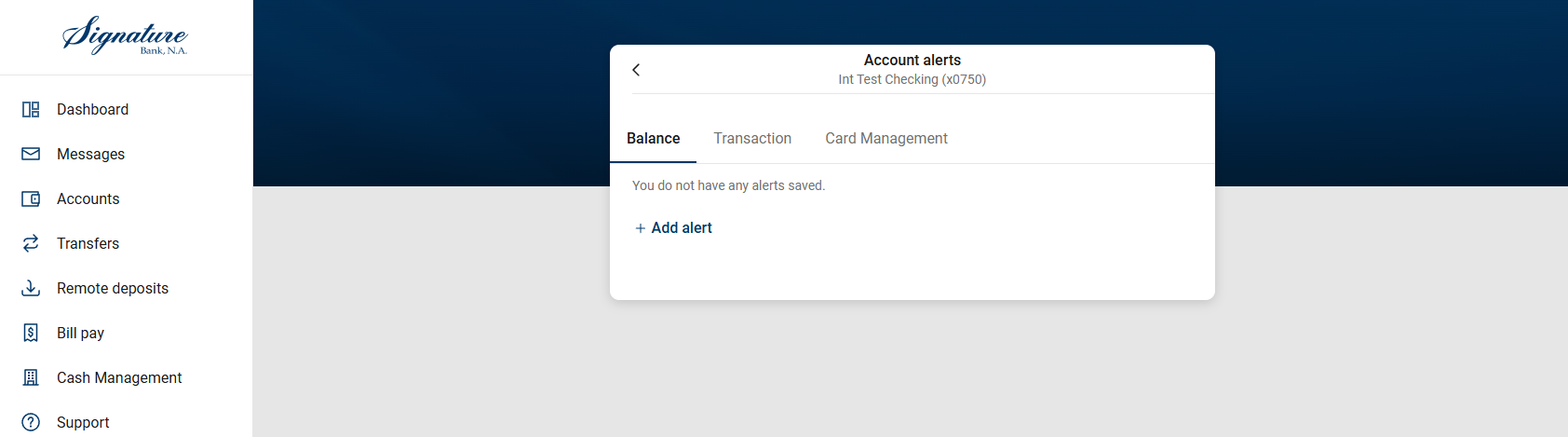

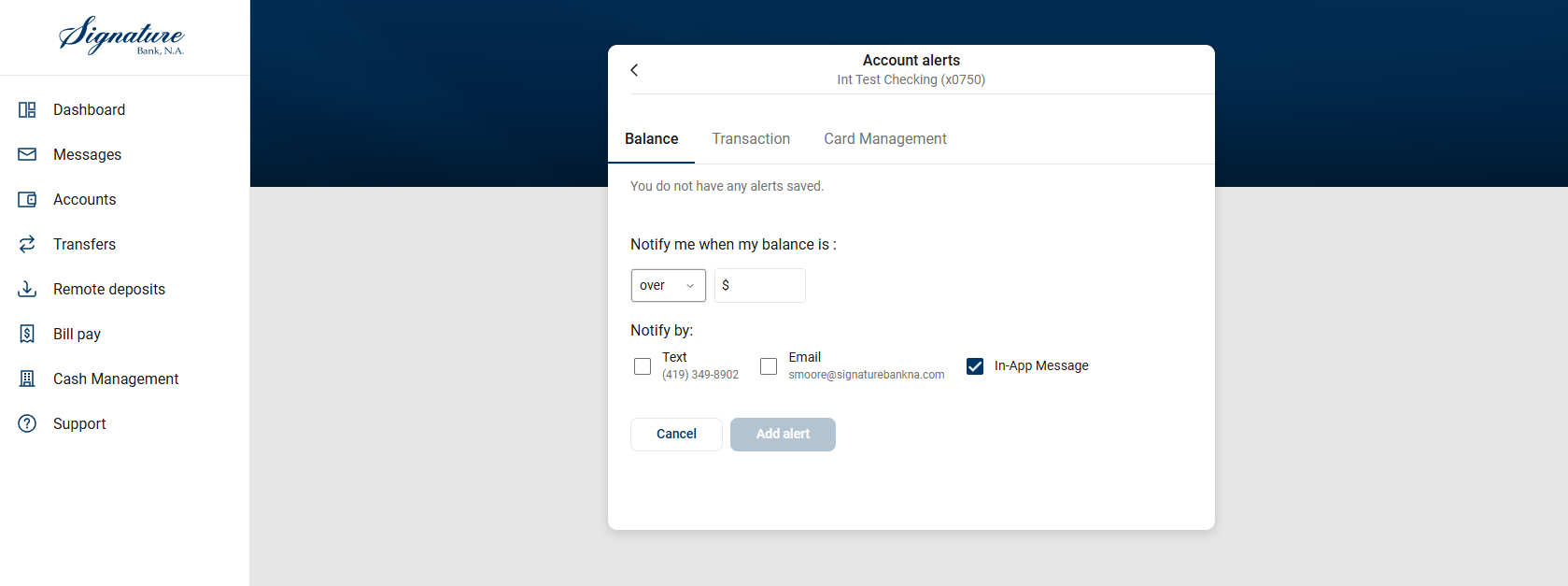

Can I sign up for SMS text alerts?

SMS text alerts are available for select alert types. You can sign up for SMS text alerts through Online Banking. The account level alerts can be edited to your preference. See the examples below:

How can I protect my 2FA method?

Remember: Never share your 2FA code with anyone—it’s your key to secure access and should be kept private. Set-up phone, authenticator, or passkey 2FA methods only on trusted personal devices that can be locked when not in use.

Can I add more than one 2FA type as a resiliency method?

Yes. Navigate to My Profile > Account Settings > Security > Two-factor Authentication > Edit Settings > Add another method

Which browsers are supported for the new Online Banking platform?

The Online Banking platform works with major modern browsers as long as they are up-to-date. If you encounter issues, please ensure your browser is updated to the latest version for optimal performance.

Mobile

Desktop

I am noticing a lag in seeing some updated information. Is there a fix for this?

Clearing your browser cache (temporary browser memory) will help speed things up.

Here’s how to clear your cache in the three major browsers without affecting your browser history:

If you like to use shortcuts, you can use Ctrl+Shift+Delete. If not, you can you can follow the instructions by browser below.

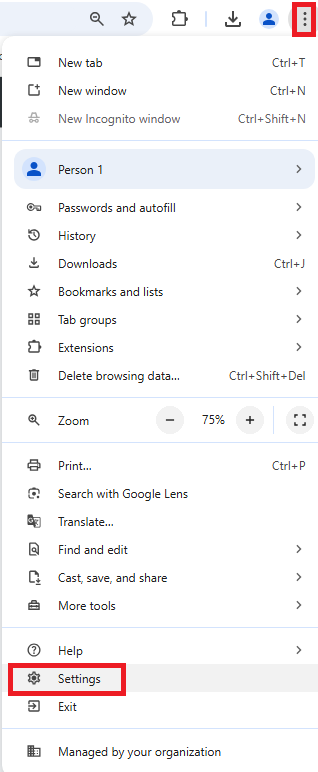

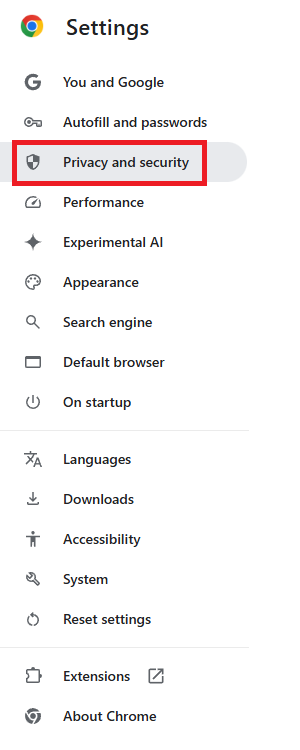

Google Chrome

- Click the three dots in the top-right corner.

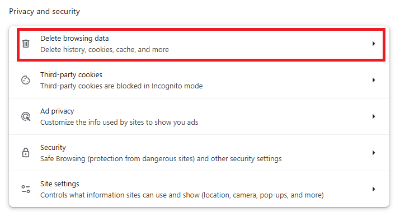

- Select Settings > Privacy and security > Delete browsing data.

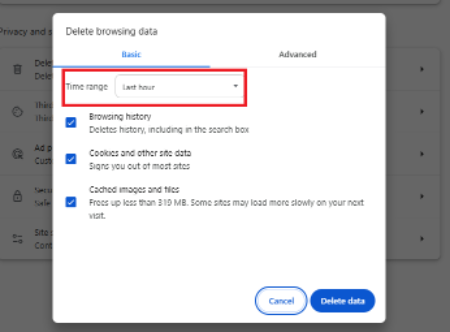

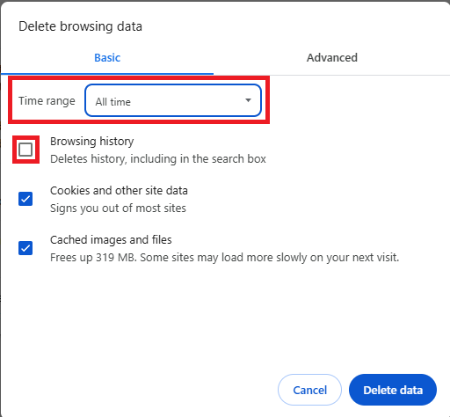

- In the pop-up:

- Under “Time range,” select All time (or your preferred range).

- Uncheck Browsing history and ensure Cached images and files is checked.

- Click Delete data.

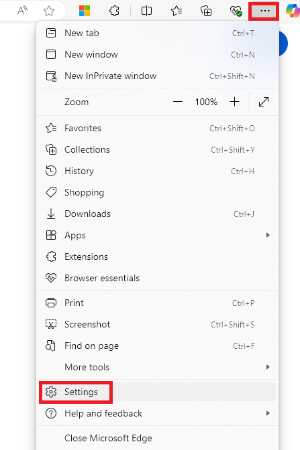

Microsoft Edge

- Click the three dots in the top-right corner.

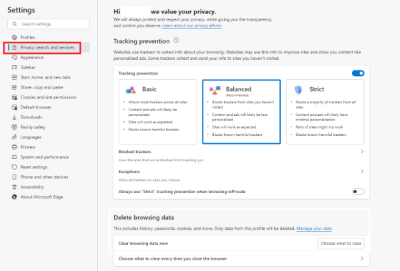

- Go to Settings > Privacy, search, and services.

- Under Clear browsing data, click Choose what to clear.

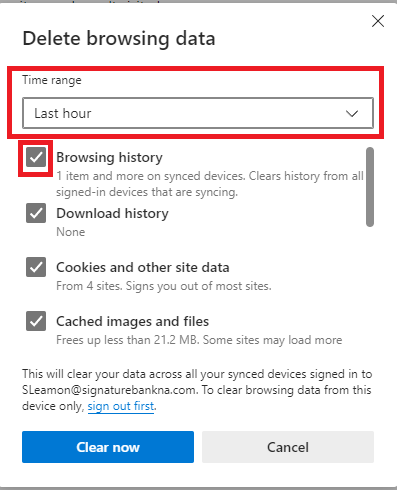

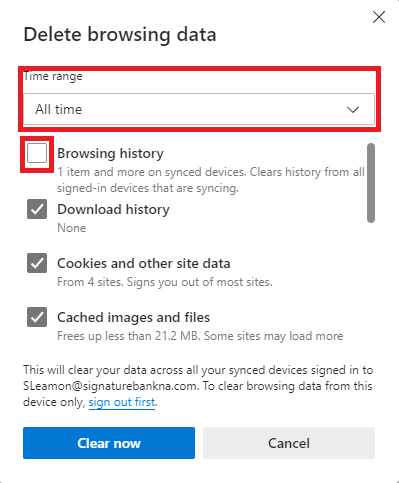

- In the pop-up:

- Under “Time range,” select All time (or your preferred range).

- Uncheck Browsing history and ensure Cached images and files is checked.

- Select your desired time range.

- Click Clear now.

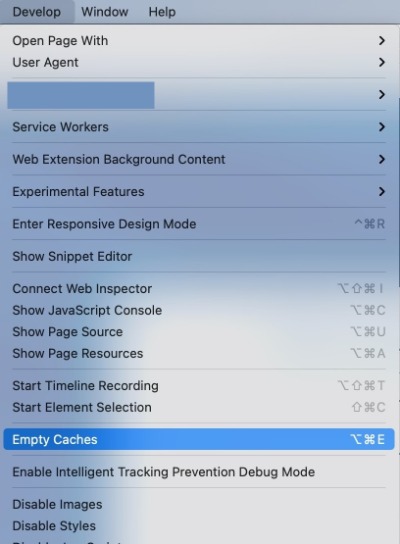

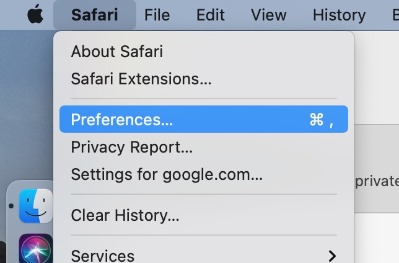

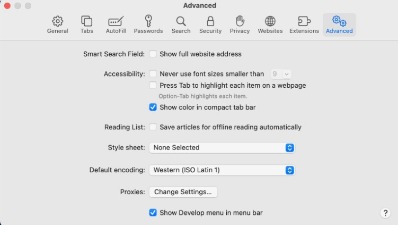

Safari (Mac)

- Click Safari in the menu bar and select Preferences.

- Go to the Advanced tab and check Show Develop menu in menu bar.

- From the menu bar, click Develop > Empty Caches.

- This clears the cache without affecting browsing history

Once you have cleared your cache, log out and back in to the platform and your slowness issues should be resolved. If they persist, please reach out to the Online Banking team at 419-841-7773 or onlinebanking@signaturebankna.com.

I do not see my company's Bill Pay Payees. Where are they?

If your company has established Bill Pay payees, choose "Manage Payments" within the Bill Pay function to access the full Bill Pay interface. If issues persist or for assistance migrating or uploading payees in bulk, contact us.

Support and Assistance

For assistance, contact us at 419-841-7773 or onlinebanking@signaturebankna.com.